|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Easy Mortgage Loans: A Complete Beginner’s GuideEmbarking on the journey to secure an easy mortgage loan can feel daunting, but understanding the basics can make the process much smoother. This guide will walk you through the essential aspects to consider when seeking an easy mortgage loan. What Are Easy Mortgage Loans?Easy mortgage loans are designed to simplify the borrowing process, making it accessible to a wider range of applicants. They often feature more flexible requirements, lower down payments, and streamlined approval processes. Benefits of Easy Mortgage Loans

How to Qualify for an Easy Mortgage LoanQualifying for an easy mortgage loan involves meeting specific criteria. Understanding these can help you prepare your application effectively. Key Requirements

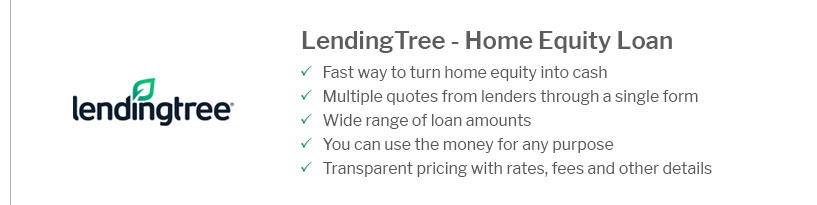

Exploring good home mortgage lenders can provide you with options that suit your needs and financial situation. Exploring Different Types of Easy Mortgage LoansThere are several types of easy mortgage loans available, each with its unique features and benefits. FHA LoansFederal Housing Administration (FHA) loans are popular among first-time homebuyers due to their low down payment requirements and easier credit standards. VA LoansAvailable to veterans and active military members, VA loans offer zero down payment and no mortgage insurance. USDA LoansThese loans are designed for rural property buyers and offer no down payment options for eligible applicants. For those looking to leverage their property’s value, an equity home mortgage might be a suitable option. FAQWhat credit score is needed for an easy mortgage loan?While credit score requirements can vary, easy mortgage loans typically accommodate scores of 580 and above. Can I get an easy mortgage loan with a low income?Yes, some lenders offer programs specifically designed for low-income applicants, assessing factors beyond income level. Are easy mortgage loans available for self-employed individuals?Yes, self-employed individuals can qualify by providing additional documentation, such as tax returns and profit/loss statements, to verify income. https://www.creditkarma.com/home-loans/i/best-mortgage-lenders

Best for conventional loans: Rocket Mortgage - Best for FHA loans: Movement Mortgage - Best for VA loans: Navy Federal Credit Union - Best for USDA ... https://myeasymortgage.com/

We work with multiple wholesale lenders to find you the best fit and lowest rates. handshake. Loan Approval. Because we offer multiple types of loans, most of ... https://www.embracehomeloans.com/

Looking for a new home loan, or want to refinance your current loan for cash back? Embrace Home Loans can meet your needs. Submit an application online ...

|

|---|